Thanks for being here!

The Alternative Data Weekly is Powered by Vertical Knowledge

Announcement(s):

I will be attending BattleFin’s January 24-26th data conference in Miami

Let me know if you’ll be there.

Theme that emerged in this week’s email is … the importance of data quality to AI models.

QUOTES

“The scramble for data is only just getting started”. - The Economist, August 2023

News Articles

Podcasts

Cool Charts

Final Thoughts (The Tease)

#1 – Lowenstein Sandler published Alternative Data is Now Mainstream; AI Could Be Next. January 2024.

My Take: Great to get these regular survey updates. I pulled some interesting charts below … but there is too much good info here, so I’d encourage you to check out the linked 28-page document. My biggest takeaway is that Alt Data is not quite mainstream, but getting close. AI, of course, is a hot topic & more than just a passing fancy. Budget growth is slowing for alt data, but increasing for AI, with a majority of firms evaluating the use of Alt Data in AI models. Stay tuned to this space … things will continue to change rapidly.

#2 – Mikiko Bazeley published Why Data Quality Is More Important Than Ever in an AI-Driven World. January 2024.

My Take: “You are what you eat” … and the same goes for AI models … bad data = bad results. This is a detailed article about training data and the impact of good/bad data as an input. If you are an AI practitioner, this article is a good read to give you a framework about how to think about how data quality impacts AI models.

BONUS: The Economist published AI is setting off a great scramble for data. August 2023 (sidenote: not sure how I missed this in August).“It is not only the size of datasets that counts. The better the data, the better the model.”

What else I am reading:

Three Data Point Thursday’s Synthetic Data In A Nutshell. January 2024.

Catherine Perloff of AdWeek published Marketers Eye Transaction Data in a World Without Cookies. January 2024.

Marcus Collins published in HBR You Need More Than Data to Understand Your Customers. December 2023.

Datos published Riding the Next Wave in Alt Data: Applications of Clickstream in Finance. January 2024.

Auren Hoffman’s 12 completely random predictions for 2024. January 2024.

Matthew Bernath published How to Monetise Data in 2024. January 2024.

Rebellion Research’s QuantVision 2024: Fordham’s Quantitative Conference

Source: Brendan Furlong of Eagle Alpha’s Profiting from Data podcast published an interview with Garrett DeSimone of OptionMetrics. September 2023.

My Take: The pricing of options is changing dramatically with more data and more data processing power. This discussion was a bit esoteric, going deep on some options metrics and terminology. Of most interest to me was the idea that the options market has changed in recent years as there has been a spike in retail interest at the same time as institutions have been getting more sophisticated & sing option markets in their day-to-day (and using services like OptionMetrics).

Other interesting topics discussed include: How to adjust to risk free rate being zero the past few years? The “tail wagging the dog” where options market is impacting equity market. Put-call ratio losing relevance as buy-ratio is more important metric (total put buy vs call buys).

Highlights (27-minute run time):

Minute 00:45 – Garret DiSimone background

Minute 03:00 – discussion of Garrett’s academic background & PhD thesis (delta neutral)

Minute 04:30 – discussion of OptionMetrics offering; implied beta; pricing of options

Minute 09:00 – box spread (determining risk free rate from options market)

Minute 10:00 – how has options market changed in the past 5-10 years?

Minute 12:00 – is the put-call ratio of any value?

Minute 14:30 – institutional market vs retail market

Minute 19:00 – crowded longs/shorts as seen by options market

Minute 21:00 – NVDA practical use case: option market anticipates earnings expectations

Minute 23:45 – why OptionsMetrics relative to competition?

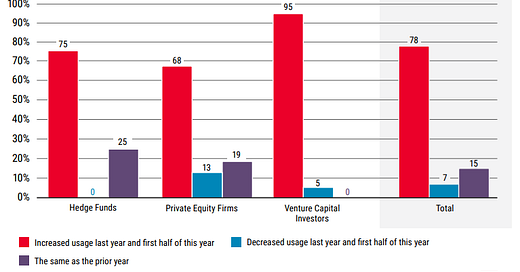

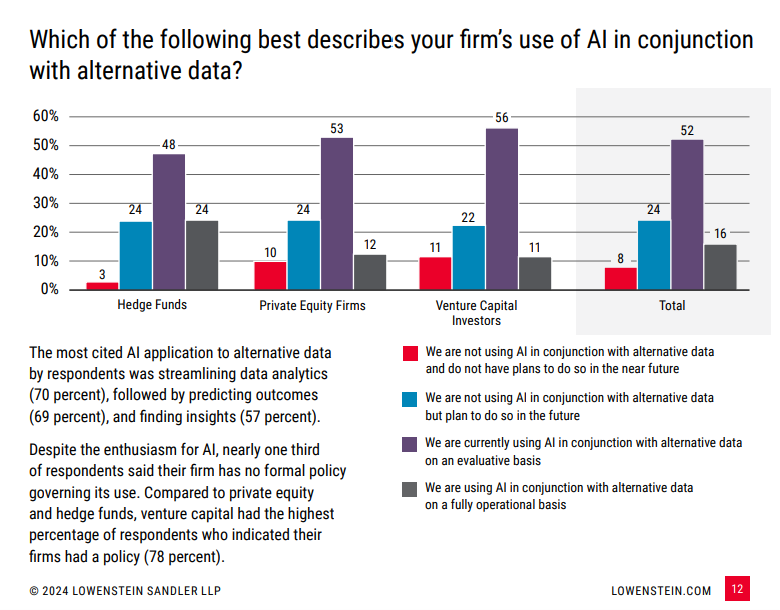

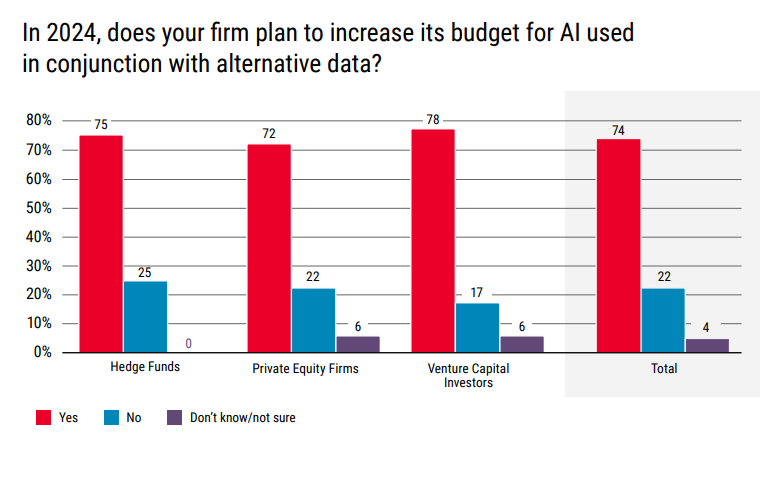

Source: Lowenstein Sandler published Alternative Data is Now Mainstream; AI Could Be Next. January 2024.

Too many good charts in this 28-page report…here are just a few:

Seeing increased usage of alternative data.

Many firms evaluating alternative data and AI.

Budget increases coming!

BONUS: Data Driven VC published 10 Predictions About The Future of VC. January 2024.

Of most interest to me was #6 Massive Disruption Through Data & AI.

The Tease … stay tuned for some *big* news coming in next week’s Alternative Data Weekly.