Special thanks to our sponsor, TradingHours.com.

TradingHours.com delivers comprehensive trading hours and market holiday data covering global financial markets. Learn more »

QUOTES

“When generative AI tools hallucinate, they are doing what they are designed to do – provide the best answer they can based on the data they have available. When they make stuff up, producing an answer that is not based in reality, it’s because they’re missing the relevant data, can’t find it, or don’t understand the question.” – Omri Shtayer

News

Pods

Charts

Final Thoughts (Creative Destruction)

#1 – Sebastian Wernicke published The Real Work of AI Isn’t Cleaning Your Data - Its Cleaning Your House. July 2025.

My Take: Similar to the “shift left” idea from Gable, data quality happens well before data is ready to be used in an application, data quality happens (or should happen) when you get the “basics” in place … like agreeing on naming conventions, the sources, and governance processes.

#2 – Emma Thwaites of the Open Data Institute published Data as a strategic asset. July 2025.

My Take: The understanding of data’s value is shifting from a “simple byproduct” of normal business activity, to a strategic asset. The UK Government published Modern Industrial Strategy, a title that does not indicate to the prospective reader that the paper has anything to do with data. But a key part of the 116-page (!) document is to “Capitalise on the value of UK data by treating it as an economic asset, enabling the use of high-quality data across the private and public sectors, extending Smart Data initiatives into relevant Industrial Strategy sectors, and establishing a clear framework to value and license public sector data assets.” (p. 12).

#3– Omri Shtayer published If Your AI Is Hallucinating, Don’t Blame the AI. June 2025.

My Take: Garbage in = garbage out. Having the models run on the right data is a key. Create agents that tell you when they are not sure or don’t have access to the required information (show the work & increase trust!).

BONUS: Rebecca Szkutak published How a data-processing problem at Lyft became the basis for Eventual. June 2025. “Self-driving cars produce a ton of unstructured data from 3D scans and photos to text and audio. There wasn’t a tool for Lyft engineers that could understand and process all of those different types of data at the same time — and all in one place. This left engineers to piece together open source tools in a lengthy process with reliability issues.”

What else I am reading:

Jason Derise published Summer Inspiration: Books, Podcasts, and Newsletters Shaping Data and Investing. July 2025.

Analytico published Why "Context‑Free" AI Feels Like a Genius With Amnesia. June 2025.

Shaili Guru published Business AI: How AI Gets Applied in the Real World. July 2025.

Karen Dynan & Matthew Shapiro published New Approaches to Constructing Economic Statistics. July 2025.

Daniel Beach published Data Cleansing for Dummies. July 2025.

Check out Neudata’s survey: 2025 'Future of the data industry'.

Alex Boden published Flaming June - Asymmetrix Newsletter #73. July 2025.

Matt Ober published Data Consumption is Changing. July 2025.

Gabriel Daaros published In a world first, Brazilians will soon be able to sell their digital data. May 2025.

Aiden McDonnell of Alt Data Marketing published Why Many Alternative Data Vendors Fail to Gain Traction and What the Best Do Differently. April 2025.

Source: JP Morgan’s Making Sense Podcast interview Patrick Hargreaves, CEO of AKO Capital and PM of the AKO Capital Global Fund. Trading Insights: Data in the discretionary investment process with AKO Capital’s CEO. June 2025.

My Take: I am curious about how data is used in discretionary investment processes. The interviewee seeks out industrialize-able and repeatable processes…plus human insight. The process is there to prevent us from making big mistakes.

He also lays out the five specialized teams who work alongside the analysts on:

market research (surveys)

forensic accounting (safety net)

behavioral analysis (language, psychology/linguistics)

data science (huge remit, across the board)

sustainability (newest team…looking through lens of all stakeholders)

Finally, Patrick highlights where machine learning and LLM tools can be additive in their processes, and where the role of the human, and of judgement, remains critical.

AI will improve existing processes (see Final Thoughts below for my take on this).

Highlights (24-minute run time)

Minute 01:00 – Introduction & investment process

Minute 05:30 – Identifying new ideas in practice (use specialist teams)

Minute 09:00 – What works well & what works less well (what delivers a signal)

Minute 10:30 – What data do we track? Separate signal vs noise

Minute 14:45 – Feedback loop (analyst & specialist teams)

Minute 15:45 – Process or Human – what is more important?

Minute 18:00 – How do you answer questions with the tools at your disposal

Minute 19:00 – Using AI tools

Minute 20:00 – Looking at public data and proprietary data

Minute 21:00 – What’s next?

BONUS: Duncan Gilchrest and Jeremy Hermann published The must-listen perspectives on data and AI. July 2025.

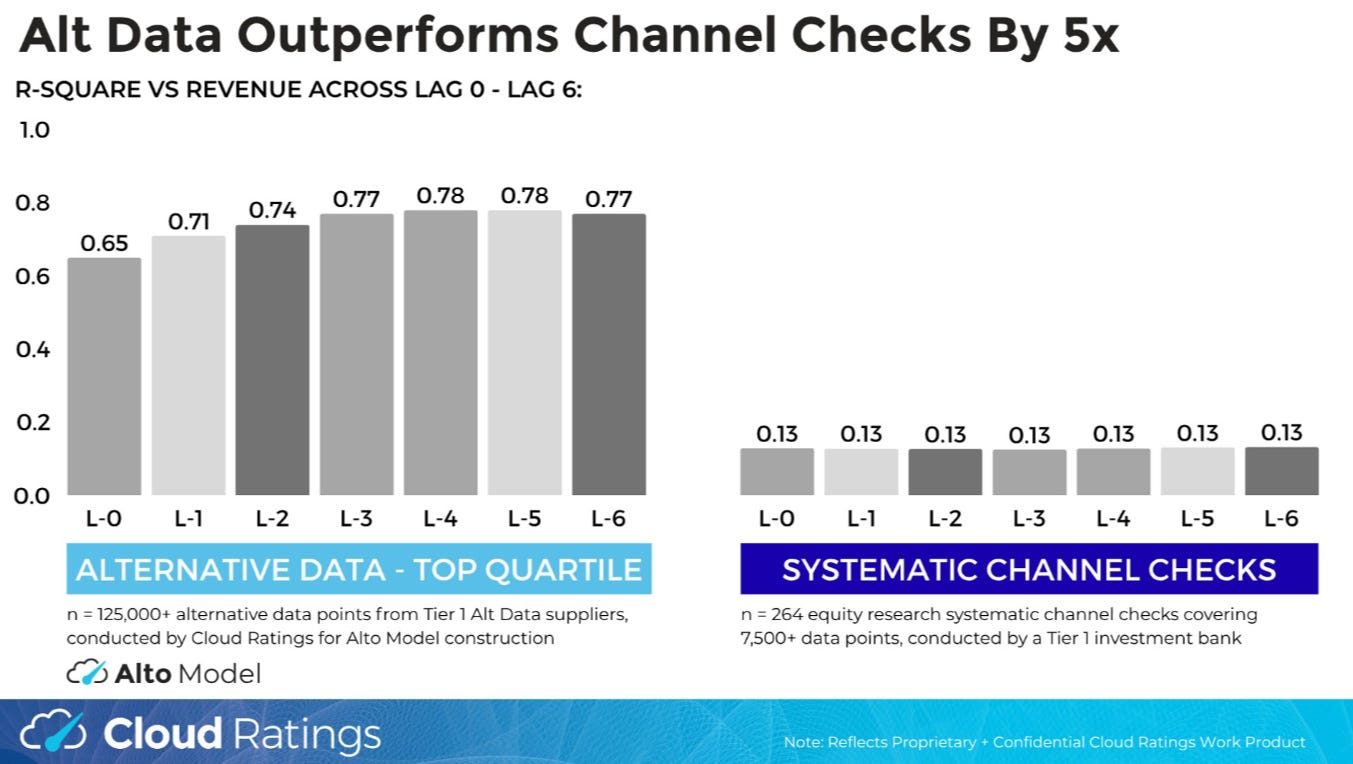

Source: Matt Harney published Better data + getting more quantitative = a solution to missed forecasts . June 2025.

Thought this was an interesting look at Channel Checks vs Alt Data.

Capitalism is built on creative destruction.

Vin Vashishata captures that in his June article AI Is Breaking The Contracts That The Internet Is Built On.

Today we are applying “AI” to old workflows. Similar to using email as a direct replacement for the fax machine.

Old workflows: A junior banker takes two days to pull together data from various sources into a credit memo for every deal. Compliance needs this memo to check boxes. Senior bankers needs to have all the information easily accessible.

Key Banker Skills: Knowing where the data lives and being diligent to not miss any details. Knowing who needs the information and in what order the information should be delivered (working the bank’s processes).

Overheard: “That junior banker is a whiz with the systems … she knows how to access all the different systems to compile the right information & never misses any detail.”

AI applied to existing workflows: AI gathers the same information as above, but more quickly and just as reliably. The credit memo is auto delivered into the existing workflows of the compliance officers & senior bankers. Two days become two minutes.

Key Banker Skills: understanding and organizing the bank’s required processes & making everything complete and repeatable. Being the human set of eyes to quickly review a draft pulled together by an AI agent.

Overheard: “I’ve got a few dozen credit memos ready to go, just need to quickly review.”

Future State: Company needs a loan. An AI Agent delivers the required information in the required format to dozens of different banks (and is perhaps perpetually doing this). The AI Agent selects the banks based on probability of success. The boxes are checked for the various compliance functions and basic filing requirements for each individual bank. The banks need to then respond based on levels of interest.

Key Banker Skills: having relationships, understanding the internal political workings of the bank, responding quickly & being a joy to work with. (I do believe the bank will want to have a human being in the process when it comes to large amounts of money. This can be for fraud reduction at a minimum).

Overheard: “OK boomer. How did this used to happen? Did you have to go through all of this with each bank individually? It must have taken weeks.”