Alternative Data Weekly #264

Theme: The changing business of data: own, organize, offer.

Note: subscribers received the same, final version of this email on Wednesday, Nov 12th. I accidentally hit “send” too early.

There is a first time for everything.

While I was mortified when I realized the email had been sent to everyone two days early, I will use this as proof that a human, not AI, runs the ADW operation.

I hope you enjoy this week’s ADW, perhaps for the second time!

Special thanks to our sponsor Datos!

Datos provides enriched clickstream data for institutional finance with tickers, domain coverage, normalization, and low-latency delivery ahead of market open. Contact Matt Nagle to know more.

QUOTES

“On the one hand you have, information sort of wants to be expensive because it is so valuable. The right information in the right place just changes your life. On the other hand, information almost wants to be free because the costs of getting it out is getting lower and lower all of the time. So you have these two things fighting against each other.” – Stewart Brand (h/t Byrne Hobart)

News

Pods

Charts

Final Thoughts (The Changing Business of Data)

#1 - Byrne Hobart published Does Information Want to be Free? October 2025.

My Take: This is a good high-level outline of a data business. Where does value accrue? How do you collect, market, and sell data to maximize the value of the asset? The most valuable data companies, like stock markets, social media, search engines, etc., collect data for free and sell the right to access the data.

I like Byrne’s articulation of the idea that hoarding the data and selling the outcome from analyzing the data (i.e. you can see the raw data, but I’ll share with you access to 18-25 year olds scrolling on my platform).

#2 – Alex Boden of Asymmetrix published Everything is a Data Business 2.0. November 2025.

My Take: Data is a weird business (see Byrne Hobart article). There is a massive opportunity to unlock the value in all this collected data. I’ve talked to dozens of data owners looking to generate high-margin revenue in a non-correlated business.

Most overestimate the external value & under-estimate the internal value of their data. The process of organizing your data for external monetization is a valuable exercise.

The value of a firm’s data is often highest internally. Use your own data to operate your own business more efficiently. Take your data seriously. Those external, high-margin revenue opportunities will flow from that effort.

#3 - Suraj Srinivasan, Robin Seibert and Mohammed Aaser published How to Monetize Your Data. November 2025.

My Take: Of course, the answer to this question is to call the author of the ADW (seriously, if you are asking this question, send me a note; this is what I do).

This is a good article that hits on all the hot-button issues companies face when thinking about commercializing their data.

“Companies must know how to collect, organize, and analyze their data. They also need to determine the best use cases and understand how they should price their offerings. And too many of them create data offerings that aren’t closely related to their core business—a move that often turns into a low-profit distraction.”

What else I am reading:

Michael Segner published Data Quality Statistics & Insights From Monitoring +11 Million Tables in 2025. November 2025.

Seattle Data Guy published We’re All Living in Different Data Decades. October 2025.

LSEG Announces Strategic Partnership with Nasdaq® to Deliver Enhanced Private Markets Data. November 2025.

AnnaMaria Andriotis and Gina Heeb published A Fight Over Credit Scores Turns Into All-Out War. October 2025.

Interesting Weekends & Nights program from NQB8 for entrepreneurs in the DC area.

Dan Entrup’s Mapping Markets. November 2025.

Tracy Clark published Is B2B Research Broken?. November 2025.

Ian from ScrapeOps published Scraping Shock: Why Web Data Is Getting Too Expensive to Scrape. October 2025.

Syed Hussain and Joseph Forooghian published The Chief Data Office Reimagined. November 2025.

Timo Dechau published Pragmatic Orthodoxy - Data Signals. November 2025.

Rebellion Research Names Mark Fleming-Williams as European Data Mind of the Year 2025.

Alex Izydorczyk published How to do Alt Data Research. November 2023.

Source: Lenny’s podcast published an interview with Jen Abel, GM of Enterprise at State Affairs and co-founder of Jellyfish, a consultancy that helps founders learn zero-to-one enterprise sales. “Sell the alpha, not the feature”: The enterprise sales playbook for $1M to $10M ARR. November 2025.

My Take: This is a podcast I was seeking. Like Jen Abel, I really enjoy this stuff (minute 69:00). I took pages of notes during this podcast.

I have gone through both the $0M → $1M, founder-led sales … and the $1M → $10M enterprise sale process.

$0 → $1M revenue (this was the focus of their first interview The ultimate guide to founder-led sales | Jen Abel)

$1M → $10M revenue (this is the focus of this second interview)

This is hard. I am good at selling and building relationships. Selling early products is difficult. The key is to get in front of the right people and get them engaged in the process (remember, they are taking an internal risk with their political capital to introduce your product).

I thought it was interesting that she is “anti-AI” … everyone is using AI tools & they are all pulling from the same database; go in a different direction.

Enterprise (big businesses) selling is a creative process. SMB sales (smaller businesses) tend to be more science than art.

For the big guys, sell the vision, not the problem. We can deliver alpha; we have a way of working that will add value to your firm. I would add, make the value obvious in the first 30 seconds.

Channel partnerships: caution! There are 100 of you on their list. You are not their priority (this has been my experience).

Highlights (80-minute run time)

Minute 04:45 – interview starts.

Minute 05:45 – defining the market you are selling to (ex. mid-market).

Minute 11:00 – sell to a gap, not a problem. Vision-casting.

Minute 16:00 – don’t discount. Get your initial price right.

Minute 25:30 – design partners (these are hard to find & very important).

Minute 28:30 – signs that this target will be a good early partner.

Minute 36:00 – selling a service vs product.

Minute 43:00 – channel partnerships (Palantir example).

Minute 45:00 – advice.

Minute 51:00 – hiring the right people (can this person cosplay the founder?).

Minute 56:00 – how to make your sales team as excited about the product as you (the founder)?

Minute 60:00 – sell the vision.

Minute 64:00 – relationships à this is how deals get done.

Minute 67:00 – no tools used; every deal is unique.

Minute 73:00 – taking it upstream.

Minute 76:00 – lightning round (X recommendations: Jason Lemkin, Gavin Baker, Jason Cohen).

BONUS: WSJ’s Alternative Indicators: Can Nevada Employment Predict Where the Economy is Headed?

“This is part one of our four-part series on alternative economic indicators.”

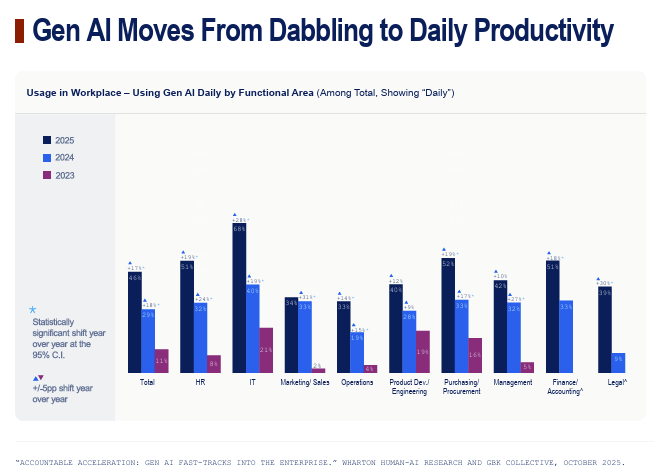

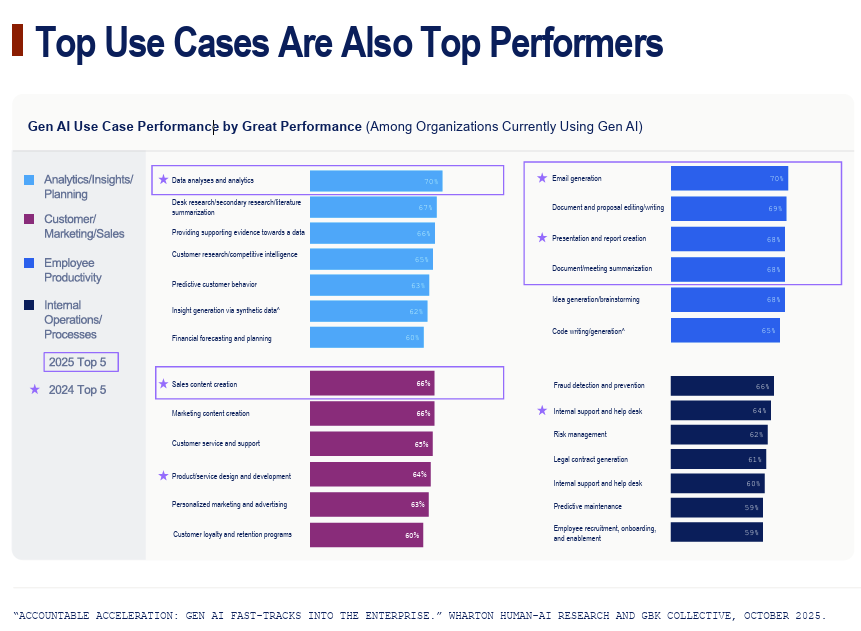

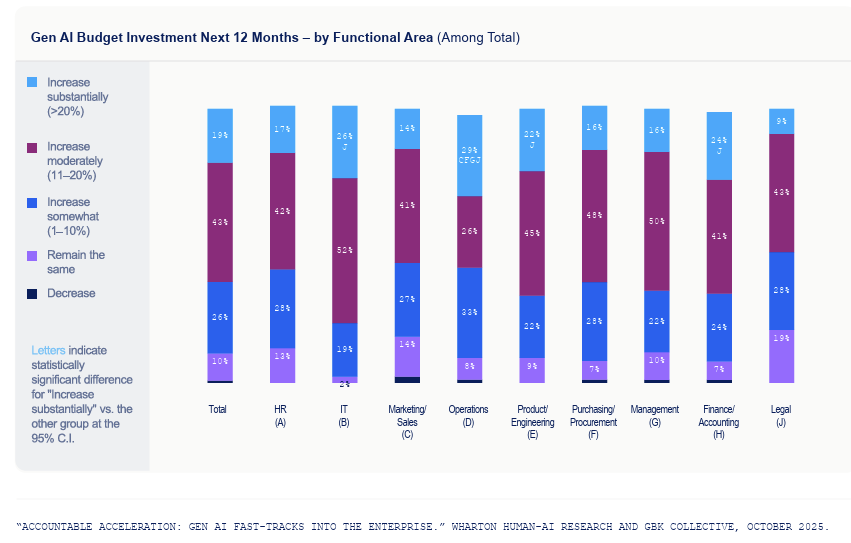

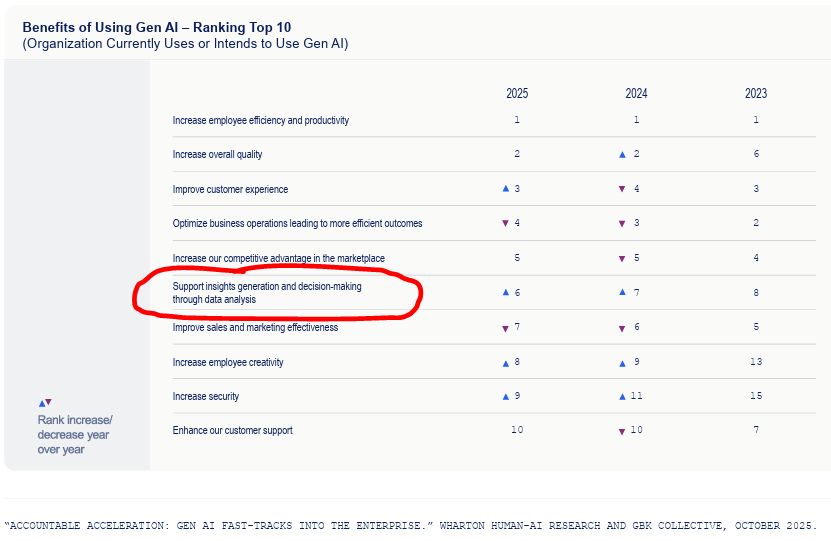

Source: Jeremy Korst, Stefano Puntoni, and Prasanna Tambe published Wharton’s AI Adoption Report. November 2025.

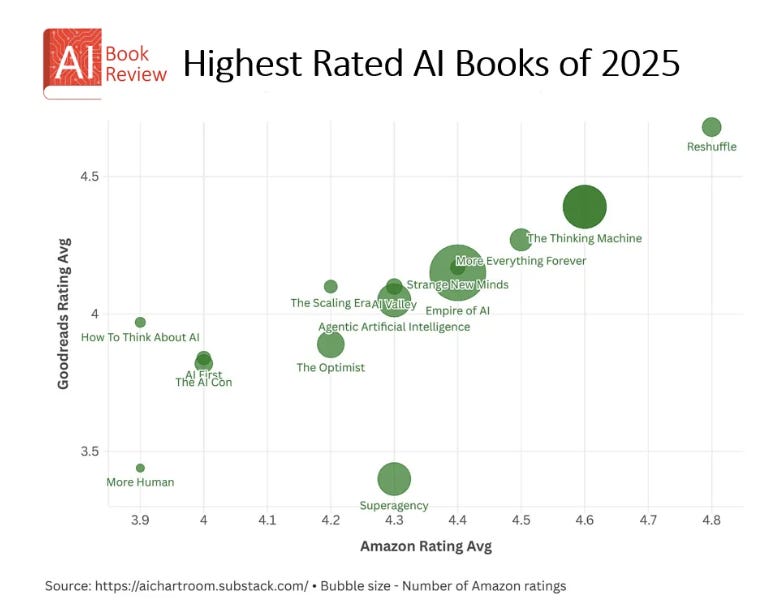

BONUS: Michael Spencer & Paul Morrison published Top AI Books to Read in 2025. November 2025.

Some weeks, I struggle to find interesting things to write about. This was not one of those weeks.

There are a TON of people trying to make sense of the business opportunity data presents in the age of AI.

If you have data or content and you don’t know what to do with it, reach out. I have a growing roster of data buyers & use cases. I can help data owners organize, prepare, and execute.

The big thing in 2025 has been the big model firms (OpenAI, Anthropic, Meta, etc.) paying hundreds of millions of dollars to get good answers, or labels, to long tail, complex questions. A few firms have experienced MASSIVE revenue growth selling to just 5-7 customers (Handshake, Scale, etc, see list below).

Q: What is the next hot market?

A: Making proprietary data actually usable by AI agents and AI applications at runtime.

Train models → labeling (this has been a huge deal in 2025).

Power agents & applications → semantic layer, access, entitlements, usage-based metering and billing (this will be the big deal in 2026+).

The agent economy is scaling fast, with thousands of vertical AI apps, workflows, copilots, and domain-specialized agents being built right now. They all need developer-native, granular, programmatic access to proprietary data. That’s a very different business from training data prep…call it: commercial activation.

Annotation companies (not a comprehensive list; they are popping up everywhere):

Minute 7:00 - “Helping frontier labs label AI data”

ScaleAI Enterprise-grade annotation and data-engineering platform powering GenAI, LLMs, RLHF & computer-vision model pipelines.

Labelbox “The data factory for AI teams” — platform + managed services to label and manage multimodal data at scale (text, image, video).

iMerit Expert-led annotation provider offering high-quality data labeling, domain specialist teams, global workforce for complex/industry-specific AI.

Telus a global annotation/data collection service that supports text, audio, image, multilingual tasks, and a large workforce for enterprise AI.

SuperAnnotate Annotation software & services platform built for multimodal data (image, video, text, audio), enabling faster AI development via human + model workflows.

Toloka.ai Crowd-annotation platform with a global pool of annotators; supports Hybrid AI + human workflows and excels in large-scale data labeling for AI models.